After registering your U.S. business, you’ll need to fulfill ongoing compliance requirements, such as filing annual reports and paying franchise taxes, to maintain its active status. You’ll also need to manage tax responsibilities, including obtaining an Employer Identification Number (EIN) and filing tax returns on time. Financial management tasks, like overseeing payroll and allocating funds for relocation costs, are also vital. Additionally, you’ll need to address legal considerations, such as opening a U.S. bank account, and develop operational strategies, like adapting to local market customs. By tackling these tasks, you’ll set your business up for long-term success, and there’s more to explore to guarantee you’re fully equipped.

21 Checklist to Maintain Your U.S. Business After Registration

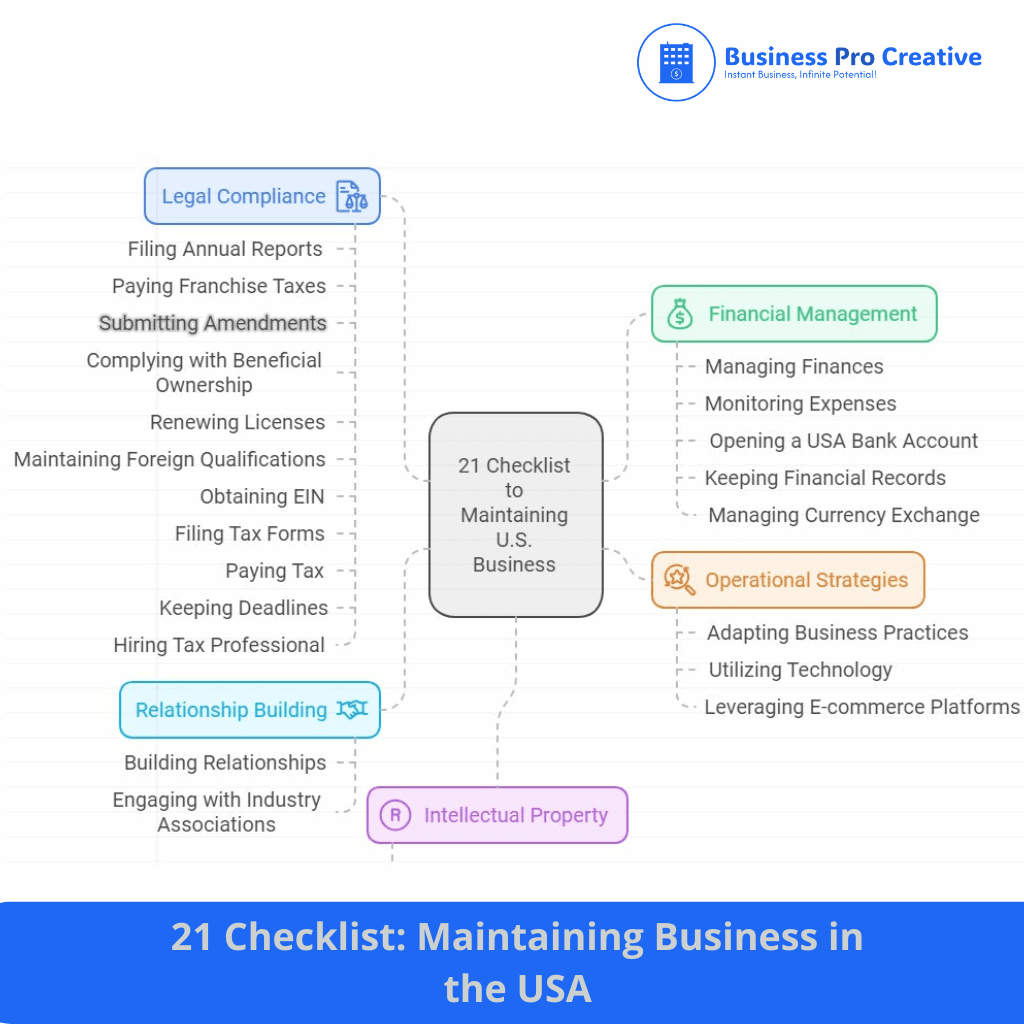

The 21 essential tasks lie ahead to guarantee your U.S. business remains compliant and thriving after registration.

To maintain your business, you’ll need to tackle these tasks, which can be categorized into several key areas that are mentioned below.

- Filing Annual Reports: Filing annual reports with the state where your business is registered,

- Paying Franchise Taxes: You must pay the franchise taxes to maintain your company’s legal status.

- Submitting Amendments: You must also submit amendments if there are changes to your company’s information, such as its name or management structure.

- Complying with Beneficial Ownership: You’ll need to comply with beneficial ownership reporting requirements.

- Renewing Licenses: You should business licenses each year without fail.

- Maintaining Foreign Qualifications: If your business operates in multiple states, you’ll need to maintain foreign qualifications.

- Obtaining EIN: You need to obtain an Employer Identification Number (EIN) from the IRS to file tax returns and pay taxes.

- Filing Tax Forms: If your business is foreign-owned, you’ll need to file Form 5472.

- Paying Tax: Paying federal, state, and local taxes on time is vital to avoid penalties.

- Keeping Deadlines: Stay informed about tax deadlines and changes in tax laws to guarantee compliance.

- Hiring Tax Professional: Consider hiring a tax professional familiar with international tax matters to guide you.

- Managing Finances: Effectively managing finances is essential for the success of your US business. You’ll need to oversee various financial aspects, including payroll and employee expenses, particularly when hiring foreign nationals who require specific visas, such as the E-2 visa.

- Protecting Intellectual Properties: Prioritize your business’s intellectual property protection, including trademarks, patents, and copyrights, which can be costly but necessary investments.

- Monitoring Expenses: Monitor your expenses and plan accordingly to guarantee your US business remains financially sound.

- Opening a USA Bank Account: This includes opening a U.S. bank account for your business, as this will help you keep your finances separate from your personal funds.

- Keeping Financial Records: You’ll also need to keep detailed financial records for tax purposes, including receipts, invoices, and bank statements.

- Managing Currency Exchange: You’ll need to manage currency exchange and international payments in accordance with U.S. laws and regulations.

- Adapting Business Practices: You’ll need to adapt your business practices to local market customs and regulations. For example, familiarize yourself with US consumer protection laws and industry-specific standards to guarantee compliance.

- Building Relationship: Building relationships with local businesses and industry associations is also pivotal. They can provide valuable insights and partnerships to help your business thrive.

- Utilizing Technology: Utilizing technology is another key aspect of operational strategies. Implement digital solutions to streamline operations, manage customer relationships, and expand your reach.

- Leveraging E-commerce Platforms: Leverage e-commerce platforms, customer relationship management (CRM) systems, and social media to stay competitive in the US market. By implementing these operational strategies, you’ll be better equipped to navigate the complexities of the US business landscape and drive growth.

What Are the Legal Requirements for Foreign Businesses in the u.s?

Stepping into the U.S. market as a foreign business can be a complex process, but understanding the legal requirements is crucial to your success.

As a foreign business owner, you must comply with federal, state, and local laws. You’ll need to obtain an Employer Identification Number (EIN) from the IRS and register with the relevant state authorities.

You may also need to obtain licenses and permits, depending on the type of business you operate. For example, if you’re in the food industry, you’ll need to comply with FDA regulations.

Additionally, you’ll need to file annual reports with the state and pay taxes on your U.S.-sourced income. Failure to comply with these requirements can result in penalties and fines, so it’s essential to stay on top of your obligations.

How Can I Establish a Physical Presence for My u.s. Business?

As you’ve navigated the complexities of U.S. business registration and compliance, your next step is to establish a physical presence for your business.

This involves setting up a tangible location where your company can operate, such as an office, warehouse, or store. You can lease or purchase a property, depending on your business needs and budget.

Consider factors like accessibility, zoning regulations, and proximity to suppliers and customers. Certify that your physical presence complies with local and state regulations, such as obtaining necessary permits and licenses.

Establishing a physical presence in the U.S. can help you build credibility, expand your market reach, and improve customer engagement. It’s essential to carefully evaluate your options and plan strategically to guarantee a successful setup.

What Are the Benefits of Forming a U.S. Corporate Subsidiary?

Numerous benefits await you when forming a U.S. corporate subsidiary, making it an attractive option for expanding your business in the American market.

By doing so, you’ll limit your liability, protecting your parent company’s assets from subsidiary-related risks. You’ll also gain tax advantages, as U.S. corporate subsidiaries are eligible for various tax deductions and credits.

Additionally, you’ll have greater flexibility in financing options, such as accessing the U.S. capital markets.

A U.S. corporate subsidiary will also allow you to hire U.S. employees, acquiring an Employer Identification Number for tax and hiring purposes.

Furthermore, a U.S. presence will enhance your company’s credibility with American customers, partners, and suppliers, potentially increasing your revenue and growth prospects in the U.S. market.

What Happens If You Do Not Maintain Your Business in the USA?

Numerous consequences await if you fail to maintain your U.S. business. You risk losing your business license, incurring penalties, and facing fines.

Failure to file annual reports and pay franchise taxes can lead to administrative dissolution. You may also be held personally liable for business debts and obligations.

Additionally, neglecting to update your business registration can result in loss of access to government contracts and grants. In extreme cases, the state may revoke your business registration, forcing you to restart the registration process.

Moreover, you may face difficulties in obtaining loans, credit, and other financial assistance. To avoid these consequences, it’s essential to stay on top of your business maintenance tasks and guarantee compliance with all regulatory requirements.