Delaware, Nevada, and Wyoming stand out as the top states for LLC formation, offering significant tax advantages and robust privacy protections. Delaware provides specialized business courts and strong corporate laws. Nevada enhances privacy through strict confidentiality measures and no state corporate taxes. Wyoming offers zero state income tax, no franchise tax, and minimal annual fees. Other tax-friendly options include South Dakota, Texas, Florida, and Montana, each offering unique benefits like no personal income tax or simplified compliance requirements. Key factors in state selection include tax structure, formation costs, legal protections, and ongoing compliance obligations. Understanding these state-specific advantages will help determine the best choice for your business needs.

Top States in the USA for LLC Formation

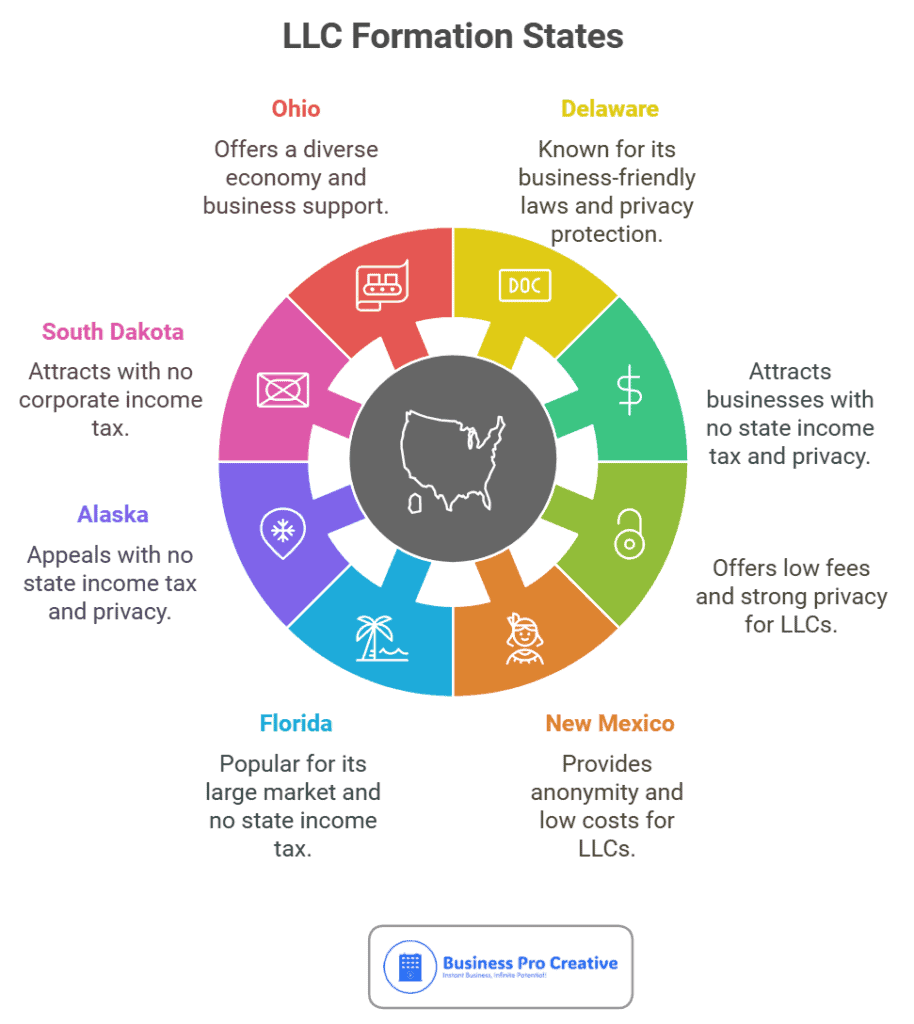

Several states stand out as particularly advantageous for LLC formation, with Delaware, Nevada, Wyoming, New Mexico, and Florida leading the pack for their business-friendly environments.

These states offer compelling benefits such as low filing fees, minimal reporting requirements, and strong privacy protections for business owners.

Delaware maintains its position as the gold standard for business formation due to its specialized business court system, while Nevada and Wyoming attract entrepreneurs with their zero state income tax policies and strong asset protection laws.

| State | Initial Filing Fee | Annual Fees | Income Tax | Privacy Protection | Application |

|---|---|---|---|---|---|

| Delaware | $90 | $300 | No | Moderate | Apply now |

| Nevada | $75 | $350 | No | High | Apply now |

| Wyoming | $100 | $60 | No | Very High | Apply now |

| New Mexico | $50 | None | No | Very High | Apply now |

| Florida | $125 | $138.75 | No | Moderate | Apply now |

| Alaska | $250 | None | No | Moderate | Apply now |

| South Dakota | $150 | None | No | High | Apply now |

| Ohio | $99 | $0 | No | Moderate | Apply now |

| Texas | $300 | $0 | No | Moderate | Apply now |

| Montana | $70 | $20 | No | Moderate | Apply now |

1. Delaware

Delaware’s business-friendly reputation has made it a powerhouse destination for LLC formations, attracting companies from across the nation and around the globe.

When it comes to state-specific requirements, Delaware’s LLC formation guide simplifies the process with its efficient registration systems. The state’s sophisticated business laws offer robust protection for business owners, while its specialized Court of Chancery efficiently handles corporate disputes.

Delaware advantages include privacy protections, tax benefits for out-of-state businesses, and streamlined registration processes.

Delaware’s disadvantages must be considered: higher registration and annual maintenance fees (up to $400 more than some states), plus the requirement to maintain a registered agent within state boundaries.

Delaware taxes include a flat annual franchise tax, which may impact operating costs. Despite these considerations, Delaware remains a top choice for entrepreneurs seeking strong asset protection and established legal precedents in business litigation.

2. Nevada

Nevada’s reputation for business privacy and tax advantages has established it as a premier destination for LLC formation. The state’s business-friendly regulatory environment offers robust privacy protection measures, shielding member information from public records and maintaining strong corporate veil protection.

The LLC formation process in Nevada is streamlined and efficient, with minimal reporting requirements and administrative burdens. Notable business incentives include no state corporate income tax, no franchise tax, and no personal income tax.

Additionally, Nevada provides strong asset protection laws and does not share information with the IRS.

However, these tax advantages primarily benefit companies conducting business within Nevada, as businesses operating in other states must still comply with their local tax obligations.

Formation fees in Nevada, which can be up to $400, tend to be higher than in other states.

3. Wyoming

Wyoming stands alongside Nevada as a leading state for LLC formation, offering many of the same advantages with even lower costs. Wyoming regulations are particularly business-friendly, with minimal reporting requirements and strong asset protection laws.

LLCs formation in Wyoming benefits the business from zero state income tax, no franchise tax, and no personal income tax. The state’s commitment to privacy stands among Wyoming’s most attractive benefits for business owners.

Wyoming’s strict privacy laws protect member identities, as the state doesn’t require public disclosure of LLC owners. Additionally, Wyoming taxes remain consistently low, with only a nominal annual report fee.

The state allows single-member LLCs and doesn’t mandate operating agreements, making it an efficient choice for entrepreneurs seeking simplified business structures with maximum protection.

4. New Mexico

New Mexico emerges as a compelling choice for LLC formation, offering particularly low filing fees and minimal ongoing compliance requirements. The state’s business climate stands out for its straightforward regulations and lack of complexity in maintaining an LLC.

The advantages of creating LLC in New Mexico are its competitive filing fees, absence of franchise taxes, and minimal reporting requirements. The state doesn’t mandate operating agreements or annual reports, reducing administrative burden.

However, New Mexico disadvantages include limited privacy protections compared to states like Wyoming or Delaware.

New Mexico taxes remain relatively favorable for businesses, with no franchise tax and competitive state income tax rates. The state’s streamlined regulations make it particularly attractive for small business owners seeking cost-effective LLC formation options, though larger enterprises may find more sophisticated benefits in other jurisdictions.

5. Florida

Florida stands out as a prime destination for LLC formation, attracting entrepreneurs with its business-friendly environment and lack of state income tax. The Florida formation process is straightforward, requiring minimal paperwork and reasonable filing fees through the Division of Corporations.

Florida LLC benefits extend beyond tax advantages, offering robust asset protection and operational flexibility. While Florida business regulations maintain certain compliance requirements, including annual reports and registered agent services, these obligations help guarantee proper business maintenance.

Florida tax incentives further enhance the state’s appeal, particularly for businesses in targeted industries and enterprise zones.

Read our guide on forming LLC in Florida to understand its compliance requirements, as LLCs must maintain proper documentation, file timely reports, and adhere to state-specific regulations. This structured approach helps businesses maintain good standing while maximizing available benefits under Florida law.

6. Alaska

Establishing an LLC in Alaska offers entrepreneurs distinct advantages, including some of the strongest privacy protections in the United States and relatively low formation fees starting at $250.

Alaska business benefits extend beyond basic asset protection, with the state offering significant LLC tax advantages through the absence of state income tax and sales tax.

The LLC formation process in Alaska is streamlined and available online, making it ideal for remote operations. Business-friendly regulations feature minimal reporting requirements, and LLC members face no residency restrictions.

The state’s commitment to privacy means member information remains confidential in public records.

Additionally, Alaska LLCs benefit from perpetual existence and flexible management structures, allowing businesses to operate efficiently while maintaining strong liability protection for owners.

7. South Dakota

South Dakota stands alongside Alaska as a premier state for LLC formation, offering entrepreneurs compelling benefits including zero state income tax and some of the lowest filing fees in the nation at just $150.

The state’s business-friendly regulatory environment makes it particularly attractive for entrepreneurs seeking efficient LLC formation processes and ongoing operational ease.

Key South Dakota benefits include strong privacy protections for business owners, minimal annual reporting requirements, and perpetual LLC duration.

The favorable business climate extends to asset protection laws, which are among the strongest in the country.

Additionally, South Dakota imposes no franchise tax, corporate income tax, or personal property tax, maximizing tax advantages for LLC owners.

The state’s streamlined administrative procedures and responsive business services division further cement its position as a top destination for LLC formation in South Dakota.

8. Ohio

The Buckeye State offers entrepreneurs a balanced mix of advantages for LLC formation, with moderate filing fees of $99 and straightforward registration processes.

The Ohio LLC formation process involves minimal bureaucratic hurdles, making it accessible for new business owners.

Ohio LLC benefits include a competitive tax structure, with no corporate income tax and a simplified Commercial Activity Tax (CAT) for businesses.

Ohio business regulations maintain flexibility while providing clear guidelines for operations. Entrepreneurs must stay current with Ohio compliance requirements, including filing annual reports and maintaining a registered agent within the state.

While not the lowest-cost option for LLC formation, Ohio’s stable business environment, central location, and growing economy make it an attractive choice for entrepreneurs seeking a reliable base for their business operations.

9. Texas

Known for its business-friendly environment, Texas ranks among the most popular states for LLC formation, offering entrepreneurs significant advantages and growth opportunities.

Forming an LLC in Texas is straightforward, with reasonable filing fees and minimal bureaucratic hurdles. Texas business advantages include no state income tax, making it particularly attractive for business owners seeking tax benefits.

Texas LLC regulations provide flexibility in management structure while offering robust liability protection. The diverse Texas industry landscape spans energy, technology, healthcare, and manufacturing sectors, creating numerous opportunities for new businesses.

The state’s strategic location, extensive infrastructure, and access to international markets further enhance its appeal. While annual franchise tax requirements exist, many small LLCs qualify for exemption, contributing to the state’s reputation as a prime destination for business formation.

10. Montana

Montana stands out as a compelling choice for LLC formation, featuring a straightforward registration process and a filing fee of $70. The state’s business environment offers entrepreneurs several advantages, including no sales tax and minimal regulatory oversight.

Creating an LLC in Montana benefits favorable tax implications, with no corporate income tax for LLCs operating as pass-through entities.

Montana regulations are business-friendly, requiring minimal paperwork and annual maintenance. The Montana economic factors contribute to a stable business climate, particularly for small businesses and startups.

The state’s simplified compliance requirements and protective business laws make it an attractive destination for LLC formation.

Montana’s business-friendly policies, combined with its low formation costs and streamlined processes, create an environment conducive to business growth and sustainability.

Should You Choose Home State or Out-of-State Formation for Your LLC?

When starting an LLC in USA, entrepreneurs must decide whether to form their business in their home state or choose another state for registration. This decision carries significant legal implications and tax considerations that can impact business operations.

Registering in your home state often provides clear benefits, including simplified compliance requirements, lower administrative costs, and better familiarity with local regulations.

However, some entrepreneurs consider out-of-state formation in places like Delaware or Wyoming for potential tax advantages or stronger privacy protections.

Before choosing out-of-state registration, carefully weigh the risks, including the need to register as a foreign LLC in your home state, additional filing fees, and maintaining multiple registered agents.

Most small businesses find that home state registration proves more practical and cost-effective unless specific circumstances justify formation elsewhere.

How Do Business Types Influence State Selection for LLC Formation?

Different business types have distinct needs that can make certain states more advantageous for LLC formation.

E-commerce businesses often benefit from states with favorable tax structures and minimal reporting requirements, while real estate LLCs typically prioritize states with strong asset protection laws and established property rights frameworks.

Startups seeking investment frequently choose Delaware due to its sophisticated business courts, investor-friendly policies, and widespread acceptance among venture capitalists.

E-commerce Businesses

For e-commerce businesses, selecting the right state to form an LLC requires careful consideration of factors like tax structure, online sales regulations, and digital infrastructure.

States like Delaware, Wyoming, and Nevada stand out due to their business-friendly environments and established e-commerce trends.

These states offer advantages aligned with online marketing needs and shipping logistics requirements.

Delaware provides strong privacy protection and favorable corporate laws, while Wyoming features low filing fees and no state income tax.

Nevada attracts e-commerce entrepreneurs with its robust payment processing infrastructure and minimal reporting requirements.

When evaluating locations, consider factors affecting customer retention, such as state-specific consumer protection laws and sales tax nexus rules.

Additionally, assess each state’s technological infrastructure, warehousing capabilities, and proximity to major shipping hubs to optimize operational efficiency.

Real Estate LLCs

Real estate investors often gravitate toward states with favorable property laws and tax advantages for their LLC formations. Texas, Florida, and Arizona consistently rank among top choices for real estate investing due to their strong market trends and landlord-friendly regulations.

These states offer robust property management opportunities and significant potential for rental income growth.

Delaware and Wyoming also attract real estate LLCs through their privacy protections and tax benefits, making them strategic choices for diversified investment strategies.

Nevada’s absence of state income tax and strong asset protection laws particularly benefit real estate investors managing multiple properties.

Additionally, Georgia and North Carolina have emerged as promising markets with appreciating property values and relatively low formation costs, offering real estate entrepreneurs compelling reasons to establish their LLCs in these jurisdictions.

Startups Seeking Investment

Startup founders’ choice of LLC formation state can greatly impact their ability to attract venture capital and angel investors. States like Delaware, California, New York, and Massachusetts consistently rank among the top destinations for startup formation due to their robust investment ecosystems and favorable business laws.

These states offer distinct advantages through established startup incubators, extensive investment networks, and active crowdfunding platforms. Delaware leads with its business-friendly courts and privacy laws, while California’s Silicon Valley provides unparalleled access to venture capital.

New York attracts fintech startups with its strong financial sector, and Massachusetts leverages its academic infrastructure for tech innovation.

When selecting a formation state, founders should consider the local investor landscape, industry clusters, and regulatory environment that best align with their startup’s growth objectives and funding needs.

What Are the Factors to Consider for LLC Formation by State?

When selecting a state for LLC formation, entrepreneurs must weigh multiple critical factors that impact both initial costs and long-term business operations.

Key considerations include state-specific tax structures, with states like Wyoming, Nevada, and Delaware offering significant tax advantages through policies such as no state income tax or corporate tax requirements.

The decision-making process should also account for varying state filing fees, annual compliance obligations, and registration procedures, which can substantially affect both startup expenses and ongoing administrative responsibilities.

Which States Offer the Most Tax-Friendly Environments for Llcs?

Selecting a tax-friendly state for LLC formation requires careful analysis of multiple financial factors. States like Wyoming, Delaware, and Nevada consistently rank among the most advantageous locations due to their favorable state tax incentives and minimal LLC formation costs.

These states offer significant tax exemptions available to businesses, including no state income tax and various asset protection benefits.

Wyoming stands out for its business-friendly regulations, with no franchise tax or personal income tax requirements.

Delaware attracts LLCs through its specialized business court system and state-specific benefits, including privacy protections.

Nevada complements its tax advantages with no information-sharing agreements with the IRS, making it particularly attractive for entrepreneurs seeking confidentiality while maintaining compliance with federal regulations.

How Do State Filing Fees Affect LLC Formation Costs?

State filing fees represent a considerable upfront cost in LLC formation and vary considerably across jurisdictions, ranging from under $50 to several hundred dollars.

When evaluating potential states for LLC formation, entrepreneurs must carefully consider both initial filing requirements and annual maintenance costs to assess the long-term financial impact on their business.

While states like Arizona ($50) and Mississippi ($50) offer relatively low filing fees, others like Massachusetts ($500) and Illinois ($150) charge markedly more.

These costs, combined with state tax implications and state-specific benefits, can greatly impact the total expense of maintaining an LLC.

Smart business owners should analyze the complete fee structure, including registration fees, registered agent requirements, and ongoing compliance costs, to make an informed decision about where to establish their LLC.

What Are the Ongoing Compliance Requirements for LLCs in Different States?

Ongoing compliance requirements for LLCs differ markedly across U.S. states, creating varying levels of administrative burden for business owners.

State regulations mandate regular filing of annual reports, payment of ongoing fees, and maintenance of current business licenses to remain in good standing.

Some states, like Delaware and Wyoming, have minimal reporting requirements and lower ongoing fees, while others, such as California and New York, impose stricter compliance obligations and higher costs.

Key considerations include adherence to compliance dates for annual report submissions, franchise tax payments, and license renewals.

States may require additional filings for multi-member LLCs or those conducting specialized business activities.

Understanding these varying requirements is essential when selecting a state for LLC formation, as non-compliance can result in penalties or dissolution.

How Does the Ease of Registration Vary Across States?

When evaluating LLC registration across states, entrepreneurs encounter considerable variations in processing times, filing requirements, and administrative procedures.

States like Delaware, Wyoming, and Nevada offer streamlined filing processes and expedited registration timelines, often processing applications within 1-3 business days. These business-friendly states provide extensive online resources and digital platforms for seamless submissions.

Conversely, states like California and New York have more complex state regulations and longer processing times, typically ranging from 5-15 business days.

Factors affecting registration ease include document requirements, state filing fees, and available business support services. Some states mandate additional permits or local registrations, while others offer one-stop solutions.

The availability of electronic filing systems, dedicated support staff, and automated verification processes also greatly impacts registration efficiency.

Conclusion

Selecting the best state for LLC formation requires careful evaluation of multiple factors, including tax implications, filing fees, compliance requirements, and business goals. While Delaware, Wyoming, and Nevada remain popular choices for their business-friendly environments, the most advantageous state often depends on specific circumstances. Thorough analysis of state regulations, operational needs, and long-term business objectives leads to informed decisions about LLC formation location, ultimately impacting business success and financial outcomes.